...

...

...

...

...

...

| Course Name |

Financial Markets and Institutions

|

|

Code

|

Semester

|

Theory

(hour/week) |

Application/Lab

(hour/week) |

Local Credits

|

ECTS

|

|

BNK 212

|

Fall/Spring

|

3

|

0

|

3

|

4

|

| Prerequisites |

None

|

|||||

| Course Language |

Turkish

|

|||||

| Course Type |

Service Course

|

|||||

| Course Level |

Short Cycle

|

|||||

| Mode of Delivery | face to face | |||||

| Teaching Methods and Techniques of the Course | DiscussionLecture / Presentation | |||||

| National Occupation Classification | - | |||||

| Course Coordinator | - | |||||

| Course Lecturer(s) | ||||||

| Assistant(s) | - | |||||

| Course Objectives | This course is to present the structure of financial markets and instruments, legislative and executive are designed to be knowledgeable in their fields. Short-term investments in bonds and stocks, as well as the supply of money market valuations of its contribution to long-term financing methods and IPOs in the primary market of new financial assets are among the objectives of the course to examine the issue. |

| Learning Outcomes |

The students who succeeded in this course;

|

| Course Description | Upon successful completion of this course, students will develop knowledge and understanding of the following topics: Analysis of financial markets and institutions function and structure, interest rates, commercial banking, central bank, role in the economy of the monetary and credit system, including financial products and international financial system issues has been prepared to provide information on money and capital market operations. |

| Related Sustainable Development Goals |

|

|

Core Courses |

X

|

| Major Area Courses | ||

| Supportive Courses | ||

| Media and Management Skills Courses | ||

| Transferable Skill Courses |

| Week | Subjects | Related Preparation |

| 1 | Why should we learn financial markets and organizations? | Yrd.Doç.Dr. Turgay Münyas .(2016) Finansal Piyasalar ve Kurumlar. Ekin Basın Yayın Dağıtım Bursa. ISBN 978-605-327-423-0 |

| 2 | Structure of the financial system and financial markets | Yrd.Doç.Dr. Turgay Münyas .(2016) Finansal Piyasalar ve Kurumlar. Ekin Basın Yayın Dağıtım Bursa. ISBN 978-605-327-423-0 |

| 3 | Regulatory and supervisory international organizations in financial markets | Yrd.Doç.Dr. Turgay Münyas .(2016) Finansal Piyasalar ve Kurumlar. Ekin Basın Yayın Dağıtım Bursa. ISBN 978-605-327-423-0 |

| 4 | Regulatory and supervisory international organizations in financial markets | Yrd.Doç.Dr. Turgay Münyas .(2016) Finansal Piyasalar ve Kurumlar. Ekin Basın Yayın Dağıtım Bursa. ISBN 978-605-327-423-0 |

| 5 | General overview of financial tools | Yrd.Doç.Dr. Turgay Münyas .(2016) Finansal Piyasalar ve Kurumlar. Ekin Basın Yayın Dağıtım Bursa. ISBN 978-605-327-423-0 |

| 6 | Money markets and tools | Yrd.Doç.Dr. Turgay Münyas .(2016) Finansal Piyasalar ve Kurumlar. Ekin Basın Yayın Dağıtım Bursa. ISBN 978-605-327-423-0 |

| 7 | Capital markets and tools | Yrd.Doç.Dr. Turgay Münyas .(2016) Finansal Piyasalar ve Kurumlar. Ekin Basın Yayın Dağıtım Bursa. ISBN 978-605-327-423-0 |

| 8 | Midterm Exam | |

| 9 | FOREX markets and rate regime | Yrd.Doç.Dr. Turgay Münyas .(2016) Finansal Piyasalar ve Kurumlar. Ekin Basın Yayın Dağıtım Bursa. ISBN 978-605-327-423-0 |

| 10 | FOREX market products | Yrd.Doç.Dr. Turgay Münyas .(2016) Finansal Piyasalar ve Kurumlar. Ekin Basın Yayın Dağıtım Bursa. ISBN 978-605-327-423-0 |

| 11 | Türev markets | Yrd.Doç.Dr. Turgay Münyas .(2016) Finansal Piyasalar ve Kurumlar. Ekin Basın Yayın Dağıtım Bursa. ISBN 978-605-327-423-0 |

| 12 | Türev market products | Yrd.Doç.Dr. Turgay Münyas .(2016) Finansal Piyasalar ve Kurumlar. Ekin Basın Yayın Dağıtım Bursa. ISBN 978-605-327-423-0 |

| 13 | Reflections of crises to the markets of the world and Turkey | Yrd.Doç.Dr. Turgay Münyas .(2016) Finansal Piyasalar ve Kurumlar. Ekin Basın Yayın Dağıtım Bursa. ISBN 978-605-327-423-0 |

| 14 | Reflections of crises to the markets of the world and Turkey | Yrd.Doç.Dr. Turgay Münyas .(2016) Finansal Piyasalar ve Kurumlar. Ekin Basın Yayın Dağıtım Bursa. ISBN 978-605-327-423-0 |

| 15 | Alternative financial markets | Yrd.Doç.Dr. Turgay Münyas .(2016) Finansal Piyasalar ve Kurumlar. Ekin Basın Yayın Dağıtım Bursa. ISBN 978-605-327-423-0 |

| 16 | Final Exam |

| Course Notes/Textbooks | Yrd.Doç.Dr. Turgay Münyas .(2016) Finansal Piyasalar ve Kurumlar. Ekin Basın Yayın Dağıtım Bursa. ISBN 978-605-327-423-0 |

| Suggested Readings/Materials | Özatay Fatih.(2020) Finansal Krizler ve Türkiye.İstanbul Doğan Egmont Yapımcılık ve Yayıncılık ISBN 978-605-09-7930-5 |

| Semester Activities | Number | Weigthing |

| Participation |

1

|

10

|

| Laboratory / Application | ||

| Field Work | ||

| Quizzes / Studio Critiques |

-

|

-

|

| Portfolio | ||

| Homework / Assignments | ||

| Presentation / Jury | ||

| Project | ||

| Seminar / Workshop | ||

| Oral Exams |

1

|

10

|

| Midterm |

1

|

40

|

| Final Exam |

1

|

40

|

| Total |

| Weighting of Semester Activities on the Final Grade |

3

|

60

|

| Weighting of End-of-Semester Activities on the Final Grade |

1

|

40

|

| Total |

| Semester Activities | Number | Duration (Hours) | Workload |

|---|---|---|---|

| Theoretical Course Hours (Including exam week: 16 x total hours) |

16

|

3

|

48

|

| Laboratory / Application Hours (Including exam week: '.16.' x total hours) |

16

|

0

|

|

| Study Hours Out of Class |

14

|

1

|

14

|

| Field Work |

0

|

||

| Quizzes / Studio Critiques |

-

|

-

|

0

|

| Portfolio |

0

|

||

| Homework / Assignments |

0

|

||

| Presentation / Jury |

0

|

||

| Project |

0

|

||

| Seminar / Workshop |

0

|

||

| Oral Exam |

1

|

6

|

6

|

| Midterms |

1

|

24

|

24

|

| Final Exam |

1

|

24

|

24

|

| Total |

116

|

|

#

|

Program Competencies/Outcomes |

* Contribution Level

|

|||||

|

1

|

2

|

3

|

4

|

5

|

|||

| 1 |

To be able to develop themselves in the subjects of obtaining the financial resources necessary for the activities of individuals and enterprises under the most favorable conditions and examining the use of the accumulated funds. |

-

|

-

|

X

|

-

|

-

|

|

| 2 |

To be able to discuss the role, importance and functions of the institutions providing banking and insurance services in the economic system |

-

|

-

|

-

|

X

|

-

|

|

| 3 |

To be able to evaluate the organizational structure, business processes, and service portfolios of banks, insurance companies, and other financial institutions operating in the sector. |

-

|

-

|

-

|

-

|

-

|

|

| 4 |

To be able to develop skills in identifying, measuring, and assessing financial and operational risks, and to acquire fundamental knowledge to understand and apply insurance products against these risks. |

-

|

X

|

-

|

-

|

-

|

|

| 5 |

To be able to recognize financial products offered in the banking and insurance sector, and to gain skills in effective marketing and sales, as well as managing long-term customer relationships. |

-

|

-

|

-

|

-

|

-

|

|

| 6 |

To be able to possess basic legal knowledge and closely monitor legislative changes relevant to the field. |

-

|

-

|

-

|

-

|

-

|

|

| 7 |

To be able to possess basic knowledge of accounting and analyze financial statements to evaluate the financial status of businesses. |

-

|

-

|

-

|

-

|

-

|

|

| 8 |

To be able to follow technological innovations in the financial sector and acquire knowledge about the role of blockchain and artificial intelligence applications in the industry. |

-

|

-

|

-

|

-

|

-

|

|

| 9 |

To be able to make decisions based on the principles of professional ethics, accountability and responsibility |

-

|

-

|

-

|

-

|

-

|

|

| 10 |

To be able to follow international financial markets and global economic indicators by using English at least at the A2 level of the "European Language Portfolio" |

-

|

-

|

-

|

-

|

-

|

|

| 11 |

To be able to analyze and interpret banking and insurance data, and to develop data-driven strategies for financial decision-making. |

-

|

-

|

-

|

-

|

-

|

|

| 12 |

To be able to acquire knowledge about the components of national and international systems and the implementation of sector policies. |

-

|

-

|

-

|

-

|

-

|

|

| 13 |

To be able to direct his/her education to a further level of education |

-

|

-

|

-

|

-

|

-

|

|

*1 Lowest, 2 Low, 3 Average, 4 High, 5 Highest

...

...

...

...

...

...

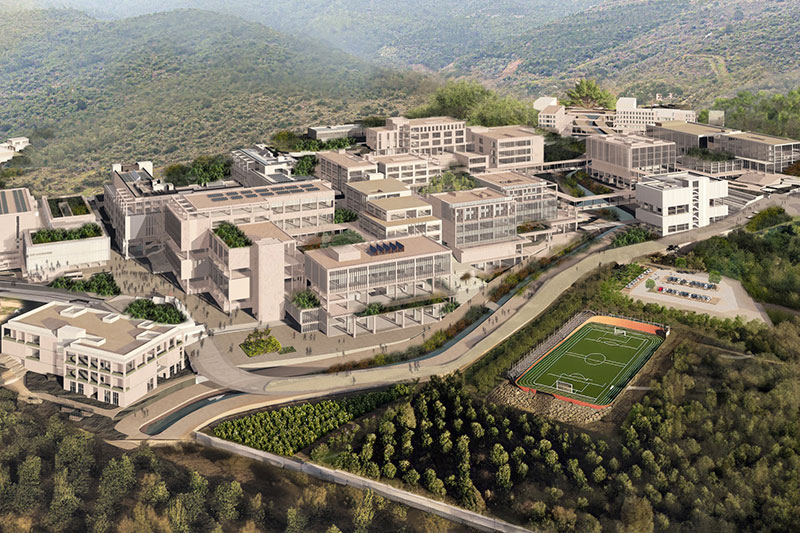

As Izmir University of Economics transforms into a world-class university, it also raises successful young people with global competence.

More..Izmir University of Economics produces qualified knowledge and competent technologies.

More..Izmir University of Economics sees producing social benefit as its reason for existence.

More..